Union Dues Documents

Union (e.g., organization or association) dues are deducted based on the processing of a union dues document in PPS. Authorization of parking fees for Smithsonian Institution employees obligated to pay parking fees to the Harvard Parking Office, Harvard University in Cambridge, Massachusetts, are also processed based on the entry of a union dues document.

Eligible employees may authorize payments of dues to labor organizations, professional associations, or other organizations through payroll deductions. A maximum of two union/ association dues in effect at the same time is allowed. If the employee has two union/ association dues withheld, each may be for different unions/associations.

The amount of dues a member pays is determined by each labor organization, professional association, or other organization. However, the authorized withholding must be compatible with the established pay periods and procedures of NFC.

The following IRIS Programs display union/association data:

- IR308, Union/Association Dues

- IR309, Union/Association Dues Transactions

- IR311, PERHIS Union/Association Dues

- IR122, SF-50B Data Elements

TMGT Table 010, Union and Association Code Address, for dues deductions. Also included on the table is the dues withholding amount or percentage for calculating dues, to avoid over/ under payment to a local or chapter.

TMGT Table 010, Union and Association Code Address

TMGT Table 010 lists all the valid union, association, and organization codes and addresses for dues deductions. Also included on the table is the dues withholding amount or percentage for calculating dues to avoid over/under payment to a local or chapter.

Bargaining Unit Status (BUS) Code

A BUS Code is a four-digit code that is entered in the position data record when the position is established and identifies the BUS for each position. The employee’s BUS code is the last four digits of the Office of Labor Management Relations (OLMR) number. An employee with a BUS code 7777 or 8888 is not entitled to dues withholding for labor organization dues, but is entitled to dues withholding for a professional association and other organizations.

Cancellation of Employee Organization Dues

PPS automatically cancels employee organization dues for:

- Movement to a Nonbargaining Position. A bargaining unit employee who is moved to a nonbargaining unit position is ineligible for inclusion in a bargaining unit. When a promotion, reassignment, position change, conversion, or change to a lower grade personnel action is processed, the dues deductions will discontinue.

- Temporary Promotion to a Nonbargaining Position. A temporary promotion to a position in a nonbargaining unit will temporarily stop dues deductions and store the membership authorization. To restore deductions and membership authorization, process a change to a lower grade.

- If an employee in a bargaining unit position is temporarily promoted to a nonbargaining unit position, and a change to a lower grade is processed moving the employee to another nonbargaining unit position, membership is canceled and no longer stored in the database.

- If a permanent promotion is processed for the nonbargaining unit position, PPS cancels membership.

The above automatic cancellations and reinstatements are effective no earlier than the end of the processing effective pay period (deductions start or stop the following pay period). If any of these actions are processed late, PPS only stops or starts the membership dues; it does not automatically adjust for over/under deductions. Enter the adjustment in SPPS Web.

Incorrect Union Dues Membership

If you enter the wrong organization code, contributions will be made to the wrong organization. In this case, cancel the incorrect union/association using the instructions under

85 Cancel/Revocation of Union Dues. Enter the correct data in EPIC Web and PMSO and enter the adjustment in SPPS Web.

Authorization of Labor Organization Dues

The employee authorizes the deduction of Labor Organization dues by completing the appropriate form to begin dues deduction.

The SF 1187, Request for Payroll Deductions for Labor Organization Dues, or other appropriate form must be completed by the employee and the union/association to authorize dues deduction when:

- The employee is a member of a labor organization which holds exclusive recognition (Memorandum of Understanding established with the Agency) for employees in the unit in which employed.

- The employee is a supervisory or management official and is a member of a supervisory or managerial association, and the Agency has agreed in writing with the association to deduct for payment of fees to maintain membership.

- The employee is a member of a professional association or organization, and the Agency has agreed in writing with the association or organization to deduct for payment of dues.

Enter the BUS code before processing the payroll document. The BUS code is entered in PMSO or FESI.

Access TMGT Table 010 to verify that the organization and applicable rates exist in PPS.

Access the applicable IRIS programs to ensure that the dues allotment data being entered is accurate and to ensure that the allotment to be entered is not currently on the database.

Entry Guidelines for Authorization of Labor Organization Dues

The following are entry guidelines for authorization of labor organization dues:

- Do not enter more than two union/local or association records for an employee.

- Prior Pay Period Adjustment Code field must be blank except if dues have been deducted in error or if the cancellation was entered prior to the first full pay period following March 1st or September 1st and not processed.

- Process a new authorization after a cancellation; do not process a change.

- The Eff Pay Period and Pay Period Year fields must be at least one year later than the effective pay period/pay period year of the authorization.

- Enter either a dues dollar amount or percent based on the union deduction indicator in TMGT Table 010.

- Do not enter a deduction amount for union dues that require special handling for processing. Special calculations are performed based on certain criteria.

- The national amount for USDA, Foreign Agricultural Services and Office of Operations, is based on a percentage of basic pay; the chapter amount is based on a flat dollar amount.

For more information, see Entering 086 Authorization of Labor Org Dues Actions.

Entering 086 Authorization of Labor Org Dues Actions

No more than two union/local or association transactions should be entered for an employee.

- To enter a 086 Authorization of Labor Org Dues action, select EPIC from the EPIC Web menu bar. The Document List page is displayed. If document has been processed, the Document List page is displayed with a list of documents. If no documents have been processed, the Document List page is blank. The New Document Selection menu is displayed. This menu displays a list of all document available for entry.

- Select New. The New Document Selection menu is displayed. Payroll documents are listed alphabetically.

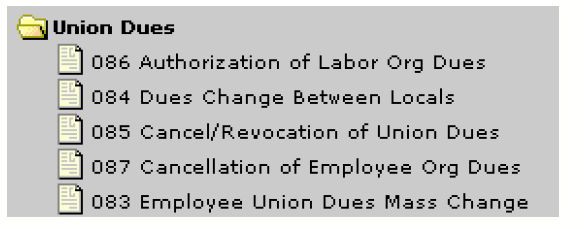

- Select the Union Dues folder. The folder expands to display the available union dues actions.

Figure 141: List of Available Union Dues

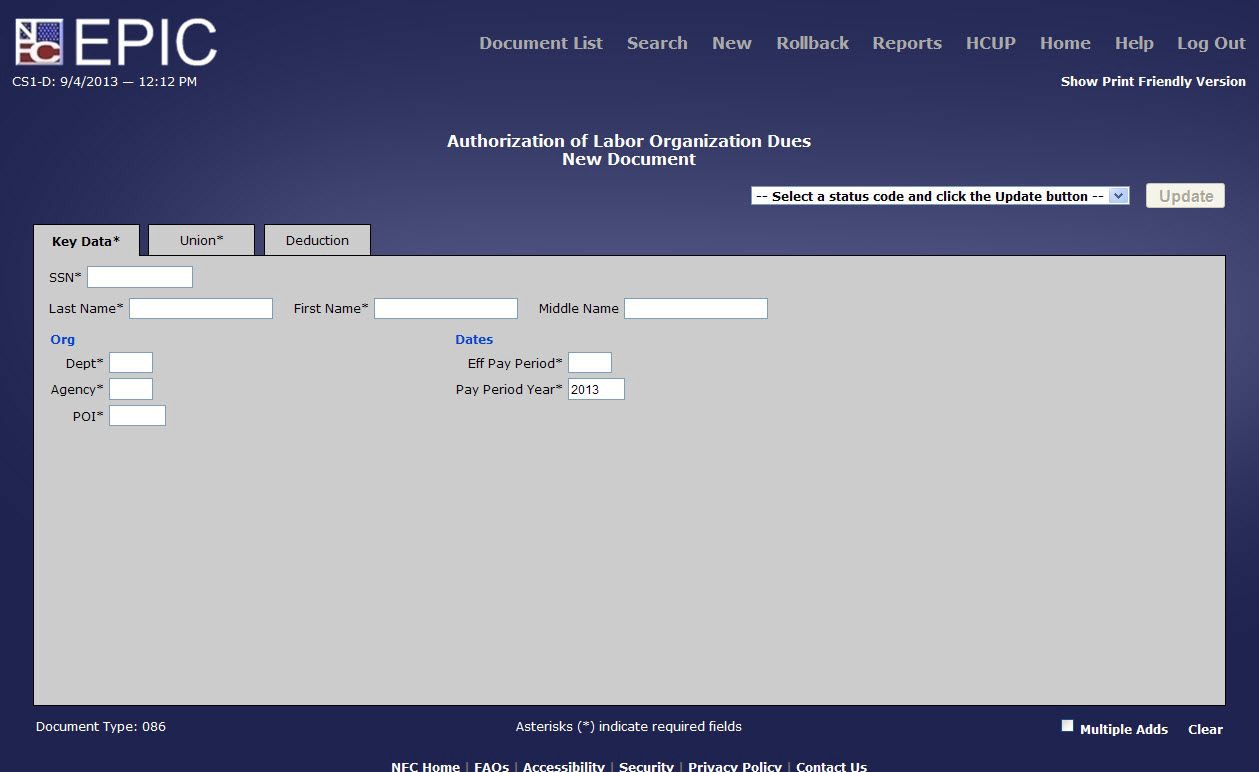

- Select 086 Authorization of Labor Org Dues. The Key Data tab is displayed.

Figure 142: Orthorization of Labor Organization Dues Key Data* Tab

- Complete the fields on the Key Data tab.

Note: Required fields are marked with an asterisk. All other fields are optional.

Eff Pay Period Field Instruction

Pay Period Year Field Instruction

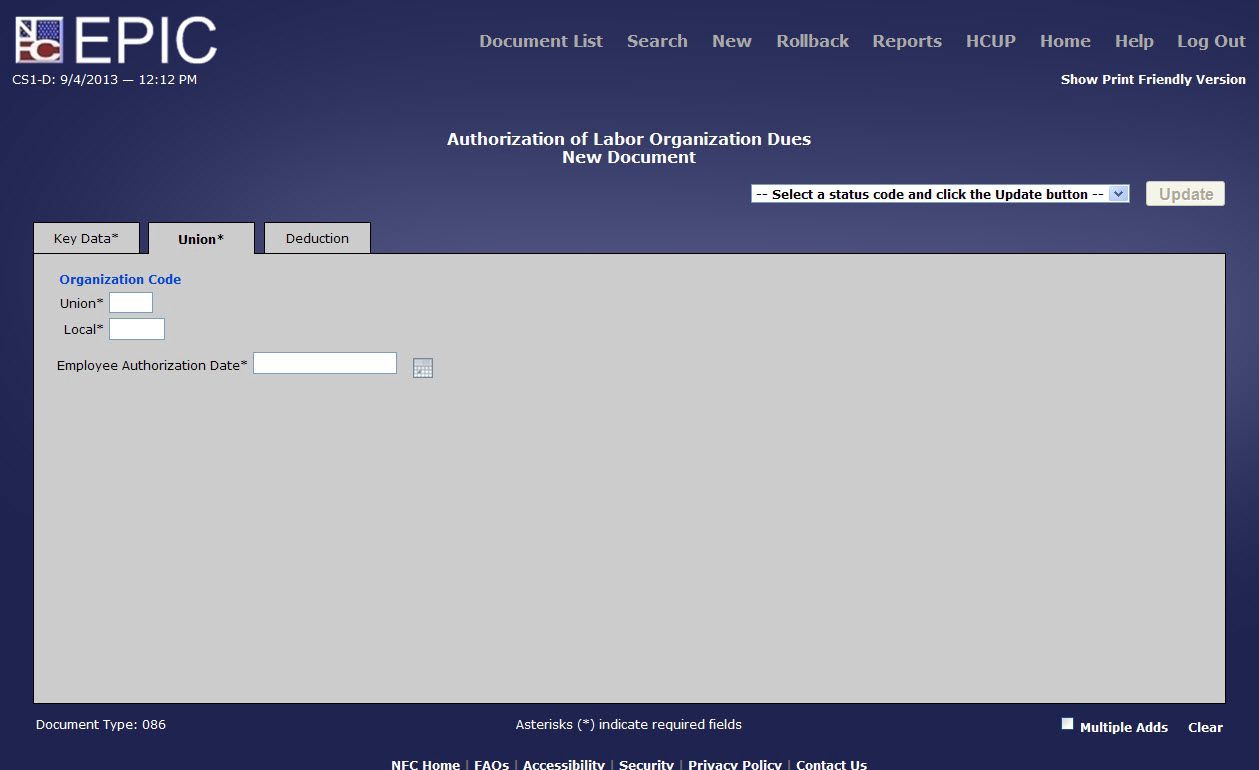

- Select the Union tab. The Union tab is displayed.

Figure 143: Authorization of Labor Organzation Dues Union* Tab

- Complete the fields on the Union tab.

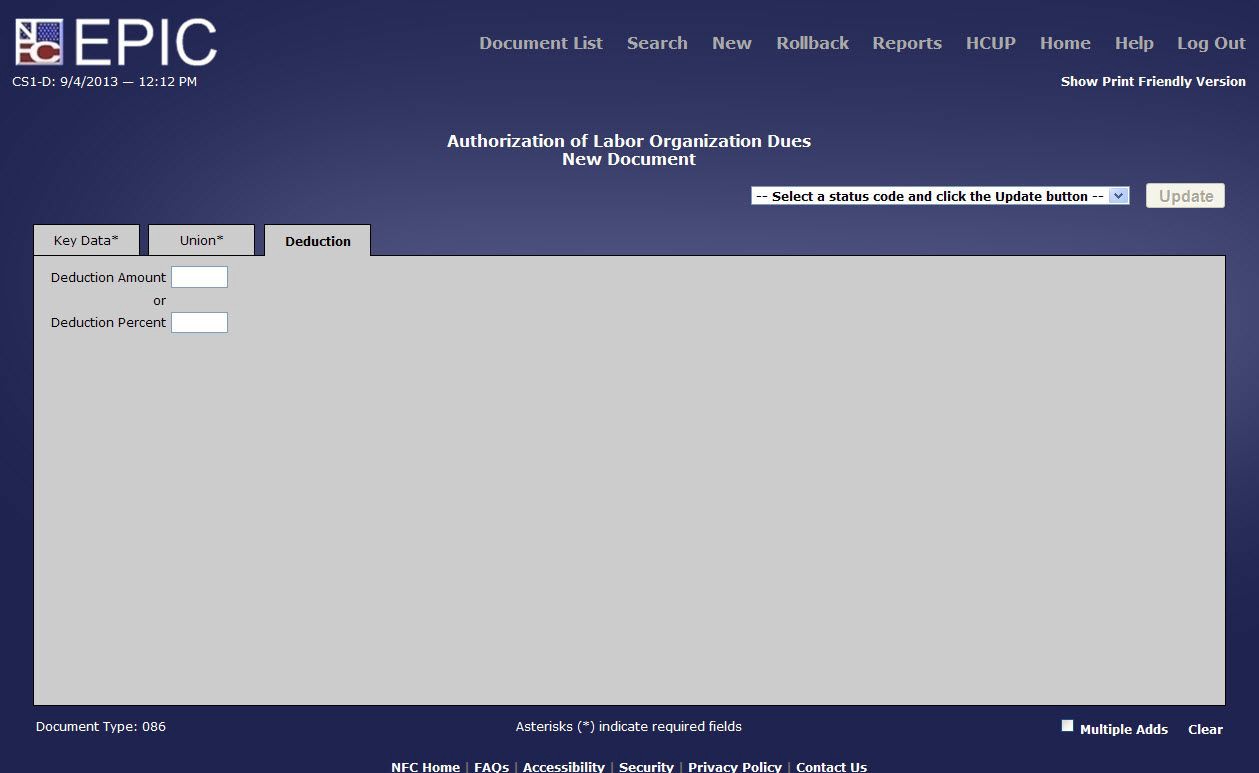

- Select the Deduction tab. The Deduction tab is displayed.

Figure 144: Authorization of Labor Organization Dues Deduction Tab

- Complete the fields on the Deduction tab.

- Select the applicable Status Input Code from the drop-down list on the top of the page. At this point, the following status input codes are available.

|

Code |

Description |

|---|---|

|

H (Hold until Release) |

To place a transaction on hold. If the status is not changed, the system will automatically delete the action after 60 days. |

|

I (Save as Incomplete) |

To save the transaction that is partially completed and held in EPIC without being edited. After completing the action, change the status code to R or H. If the status code is not changed, EPIC Web will automatically delete the action after 60 days. |

|

R (Release for Processing) |

To release the transaction from EPIC Web to be edited in PINE. |

- Select the Update button to save the entries.

Note: To add an additional address without returning to the menu, select the Multiple Adds link on the bottom right corner of the page. The page is refreshed for the next entry.

Dues Change Between Locals

Dues change between locals is a transfer of dues deduction when an employee transfers to another Agency within the same Department or a different labor organization/association within the same Agency. If an employee is reassigned or transferred to a location represented by a different local or chapter of the same labor organization and the employee continues to hold a bargaining unit position, the membership dues record may be changed to show the new local/chapter and the amount of the membership dues.

For more information, see Entering 084 Change Between Locals Actions.

Entering 084 Change Between Locals Actions

- To enter a 084 Change Between Locals action, select EPIC from the EPIC Web menu bar. The Document List page is displayed. If document has been processed, the Document List page is displayed with a list of documents. If no documents have been processed, the Document List page is blank.

- Select New. The New Document Selection menu is displayed. Payroll documents are listed alphabetically.

- Select the Union Dues folder. The folder expands to display the available union dues actions.

- Select 084 Dues Change Between Locals. The Key Data tab is displayed.

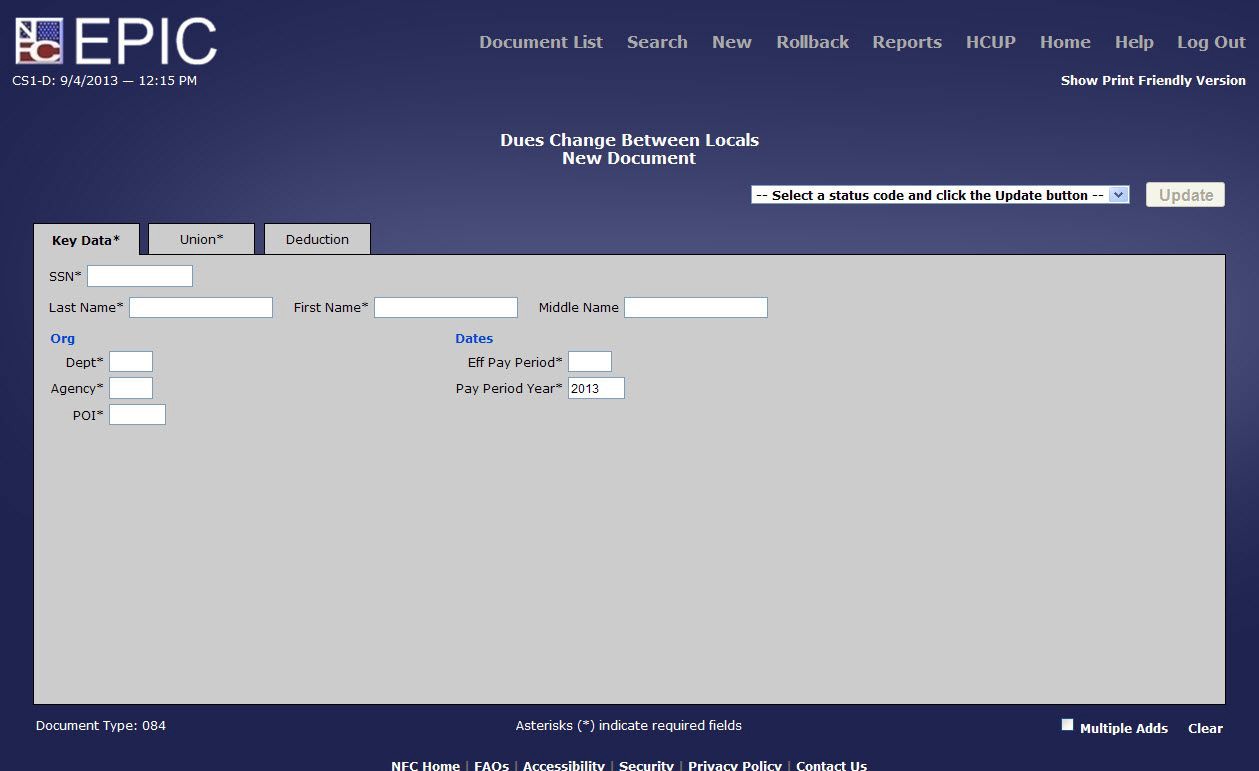

Figure 145: Dues Change Between Locals Key Data* Tab

- Complete the fields on the Key Data tab.

Note: Required fields are marked with an asterisk. All other fields are optional.

Eff Pay Period Field Instruction

Pay Period Year Field Instruction

- Select the Union tab. The Union tab is displayed.

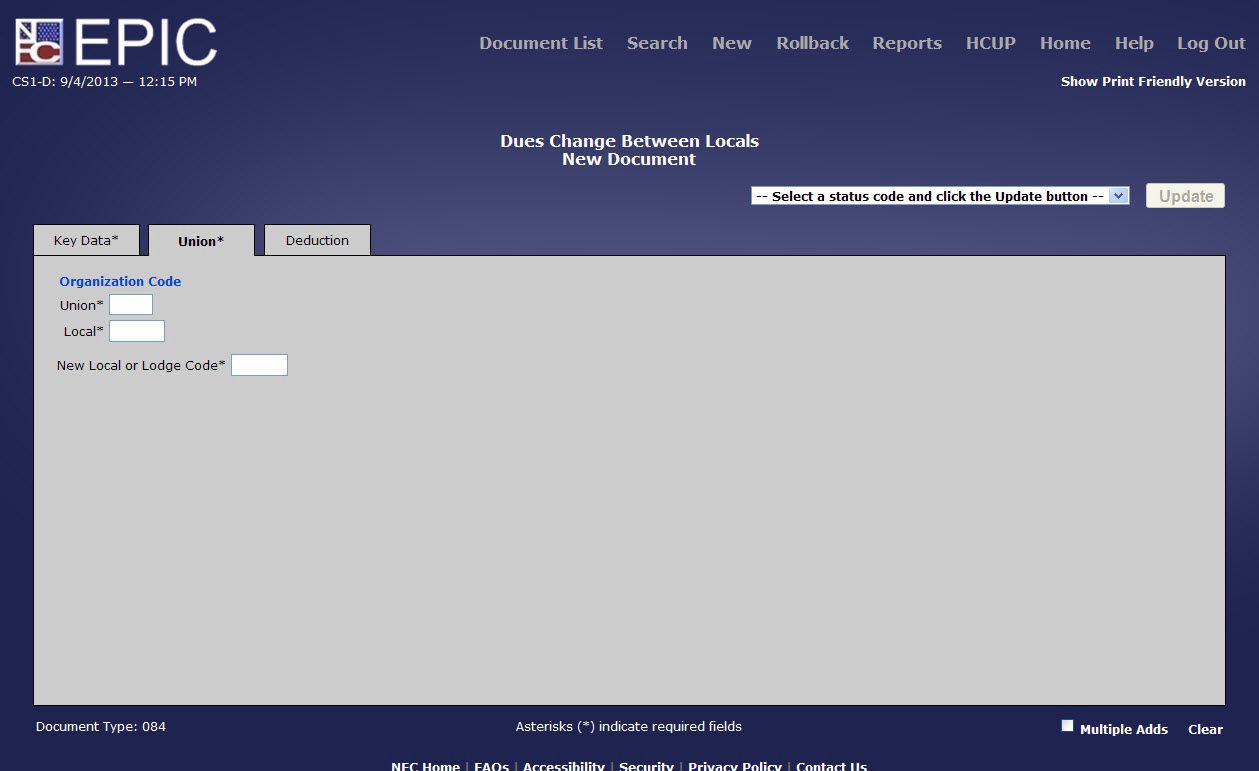

Figure 146: Dues Change Between Locals Union* Tab

- Complete the fields on the Union tab.

- Select the Deduction tab. The Deduction tab is displayed.

Figure 147: Dues Change Between Locals Deduction Tab

- Complete the fields on the Deduction tab.

Deduction Amount Field Instruction

Deduction Percentage Field Instruction

- Select the applicable Status Input Code from the drop-down list on the top of the page. At this point, the following status input codes are available.

|

Code |

Description |

|---|---|

|

H (Hold until Release) |

To place a transaction on hold. If the status is not changed, the system will automatically delete the action after 60 days. |

|

I (Save as Incomplete) |

To save the transaction that is partially completed and held in EPIC without being edited. After completing the action, change the status code to R or H. If the status code is not changed, EPIC Web will automatically delete the action after 60 days. |

|

R (Release for Processing) |

To release the transaction from EPIC Web to be edited in PINE. |

- Select the Update button to save the entries.Note: To add an additional address without returning to the menu, select the Multiple Adds link on the bottom right corner of the page. The page is refreshed for the next entry.

Cancel/Revocation of Union Dues

The cancellation/revocation of union dues is the discontinuance of dues deduction when the employee is no longer eligible or voluntarily elects to cancel membership. The Form SF-1188, Cancellation of Payroll Deduction for Labor Organization Dues, or other appropriate form is used to enter the data.

Cancellation of employee union/organization dues applies when:

- A reassignment to a location not represented by the labor organization or professional association for which dues were withheld prior to the reassignment occurs.

- The employee is no longer a member in good standing.

- The employee is reassigned or transferred to a bargaining unit represented by a different local of the same local organization and does not wish to continue dues withholding.

- A cancellation is effective immediately or in the pay period in which it is entered. For example, if the cancellation was entered in Pay Period 19, deductions will stop in Pay Period 19.

Union Dues Revocation

Certain labor organizations designate when an employee may revoke labor organization withholding; other organizations permit revocations at any time. TMGT Table 010 includes the Revocation EFF Date field that indicates when revocation of membership is allowed.

Revocation EFF Date Code 0 indicates that membership can be canceled at any time. If the organization permits revocation at any time, enter the revocation at any time prior to the effective pay period.

Note: The revocation code does not change until BEAR processes which is after the processing of PAYE. Therefore, deductions will be withheld in the pay period the revocation was entered and will stop in the following pay period (or the established revocation pay period).

Note: If the revocation date is not specified by the organization and the date falls on any day of a given pay period, the revocation may be entered at any time before or during the pay period of the revocation date. However, the revocation will not be effective until the designated pay period.

Note: When entering a revocation of employee union dues, use the current pay period as the effective pay period. PPS will stop dues deductions based on the first approved revocation date following the end of the current pay period. The pay period the revocation is to be effective should never be used as the effective pay period. If it is, the document will apply to the database too late to stop deductions for the pay period intended. Instead PPS will stop deductions based on the approved revocation date.

Entering 085 Cancel/Revocation of Union Dues Actions

- To enter a 085 Cancel/Revocation of Union Dues action, select EPIC from the EPIC Web menu bar. The Document List page is displayed. If document has been processed, the Document List page is displayed with a list of documents. If no documents have been processed, the Document List page is blank.

- Select New. The New Document Selection menu is displayed. Payroll documents are listed alphabetically.

- Select the Union Dues folder. The folder expands to display the available union dues actions.

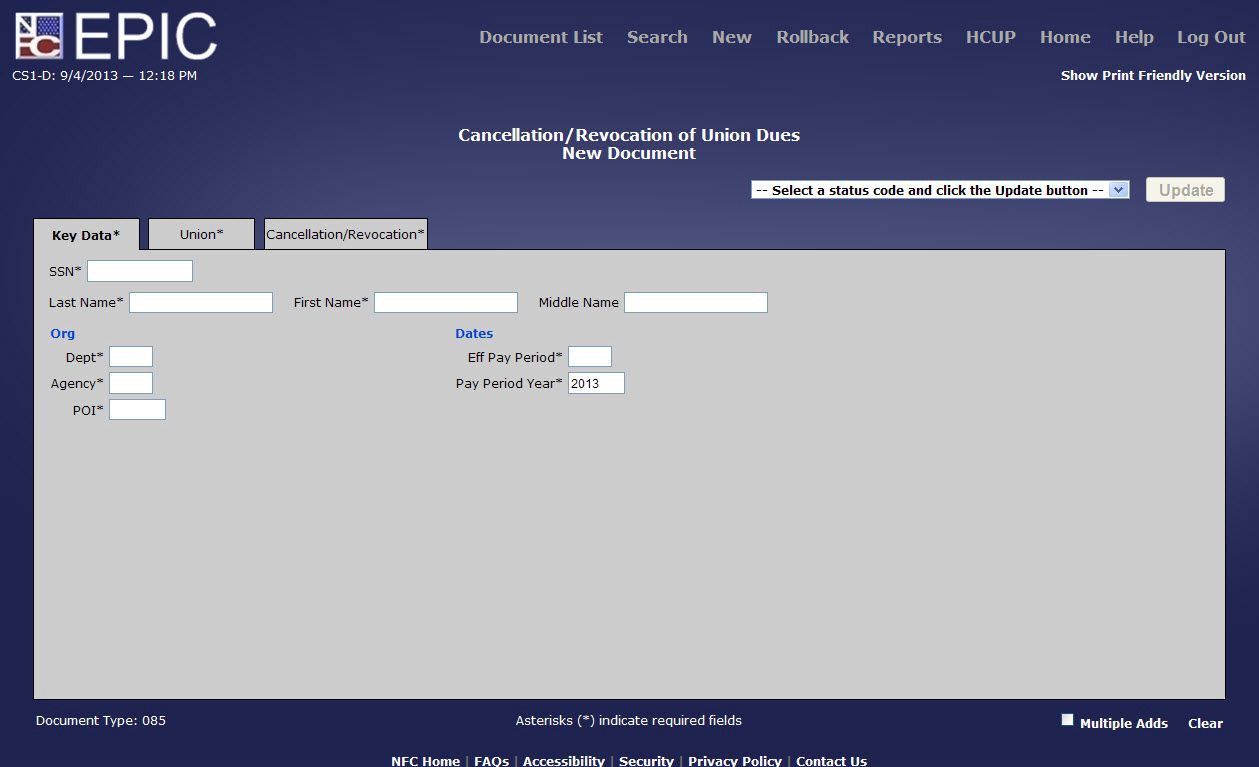

- Select 085 Cancel/Revocation Of Union Dues. The Key Data tab is displayed.

- Complete the fields on the Key Data tab.

Note: Required fields are marked with an asterisk. All other fields are optional.

Eff Pay Period Field Instruction

Pay Period Year Field Instruction

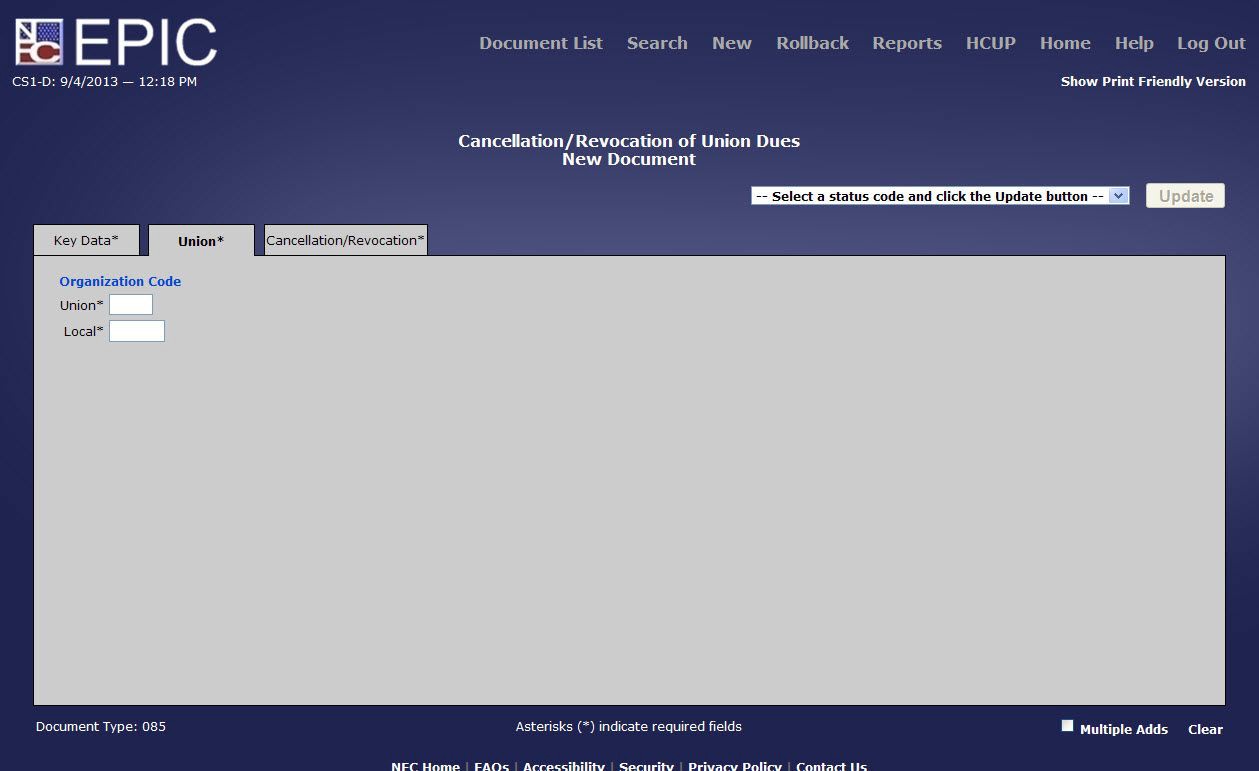

- Select the Union tab. The Union tab is displayed.

Figure 149: Cancellation/Revocation of Union Dues Union* Tab

- Complete the fields on the Union tab.

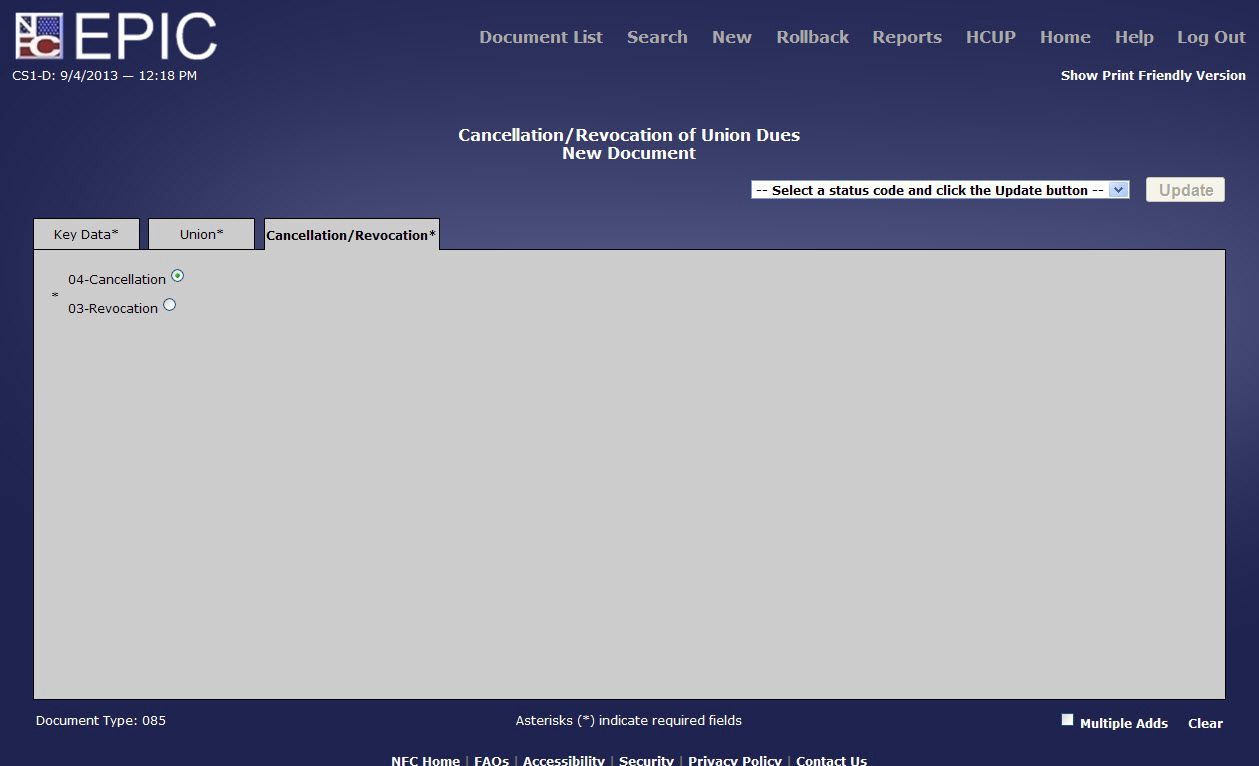

- Select the Cancellation/Revocation tab. The Cancellation/Revocation tab is displayed.

Figure 150: Cancellation/Revocation of Union Dues Cancellation/Revocation* Tab

- Complete the fields on the Cancellation/Revocation tab.

- Select the applicable Status Input Code from the drop-down list on the top of the page. At this point, the following status input codes are available.

|

Code |

Description |

|---|---|

|

H (Hold until Release) |

To place a transaction on hold. If the status is not changed, the system will automatically delete the action after 60 days. |

|

I (Save as Incomplete) |

To save the transaction that is partially completed and held in EPIC without being edited. After completing the action, change the status code to R or H. If the status code is not changed, EPIC Web will automatically delete the action after 60 days. |

|

R (Release for Processing) |

To release the transaction from EPIC Web to be edited in PINE. |

- Select the Update button to save the entries.

Note:To add an additional address without returning to the menu, select the Multiple Adds link on the bottom right corner of the page. The page is refreshed for the next entry.

Cancellation of Employee Org Dues

The cancellation of employee organizational dues is the discontinuance of dues deduction when the employee no longer elects to have dues deducted for membership fees for organizations (other than Union). Form SF 1188, Cancellation of Payroll Deduction for Labor Organization Dues, is used to enter the data.

Entering 087 Cancellation of Employee Org Dues Actions

- To enter a 087 Cancellation of Employee Org Dues action, select EPIC from the EPIC Web menu bar. The Document List page is displayed. If document has been processed, the Document List page is displayed with a list of documents. If no documents have been processed, the Document List page is blank.

- Select New. The New Document Selection menu is displayed. Payroll documents are listed alphabetically.

- Select the Union Dues folder. The folder expands to display the available union dues actions.

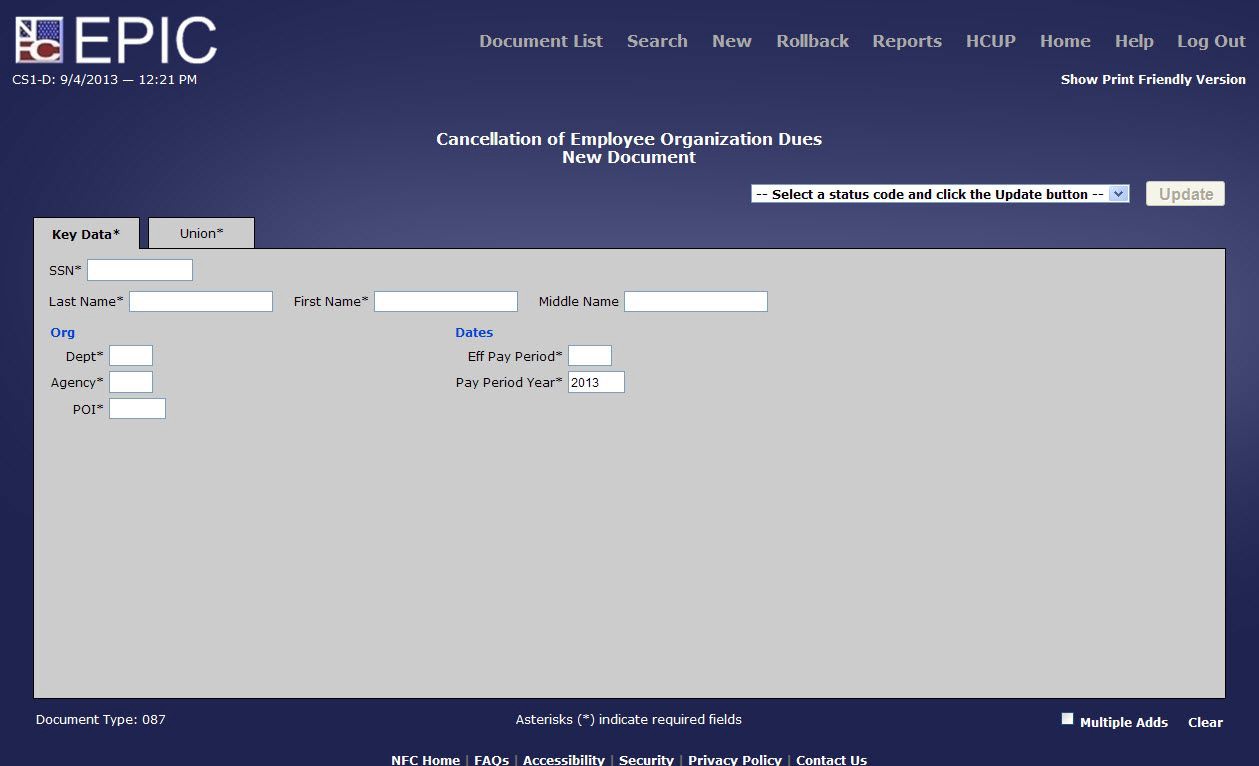

- Select 087 Cancellation of Employee Org Dues. The Key Data tab is displayed.

Figure 151: Cancellation of Employee Organization Dues Key Data* Tab

- Complete the fields on the Key Data tab.

Note: Required fields are marked with an asterisk. All other fields are optional.

Eff Pay Period Field Instruction

Pay Period Year Field Instruction

- Select the Union tab. The Union tab is displayed.

Figure 152: Cancellation of Employee Organization Dues Union Tab

- Complete the fields on the Union tab.

- Select the applicable Status Input Code from the drop-down list on the top of the page. At this point, the following status input codes are available:

|

Code |

Description |

|---|---|

|

H (Hold until Release) |

To place a transaction on hold. If the status is not changed, the system will automatically delete the action after 60 days. |

|

I (Save as Incomplete) |

To save the transaction that is partially completed and held in EPIC without being edited. After completing the action, change the status code to R or H. If the status code is not changed, EPIC Web will automatically delete the action after 60 days. |

|

R (Release for Processing) |

To release the transaction from EPIC Web to be edited in PINE. |

- Select the Update button to save the entries.

Note: To add an additional address without returning to the menu, select the Multiple Adds link on the bottom right corner of the page. The page is refreshed for the next entry.

083 Employee Union Dues Mass Change

A union dues mass change is used to enter multiple union dues transactions that are alike. If more than 100 employees are affected, NFC can provide special assistance with entering these documents. Submit these reports in writing to NFC, Applications Systems Division.

Entering 083 Employee Union Dues Mass Change Actions

- To enter a 083 Employee Union Dues Mass Change action, select EPIC from the EPIC Web menu bar. The Document List page is displayed. If document has been processed, the Document List page is displayed with a list of documents. If no documents have been processed, the Document List page is blank.

- Select New. The New Document Selection menu is displayed. Payroll documents are listed alphabetically.

- Select the Union Dues folder. The folder expands to display the available union dues actions.

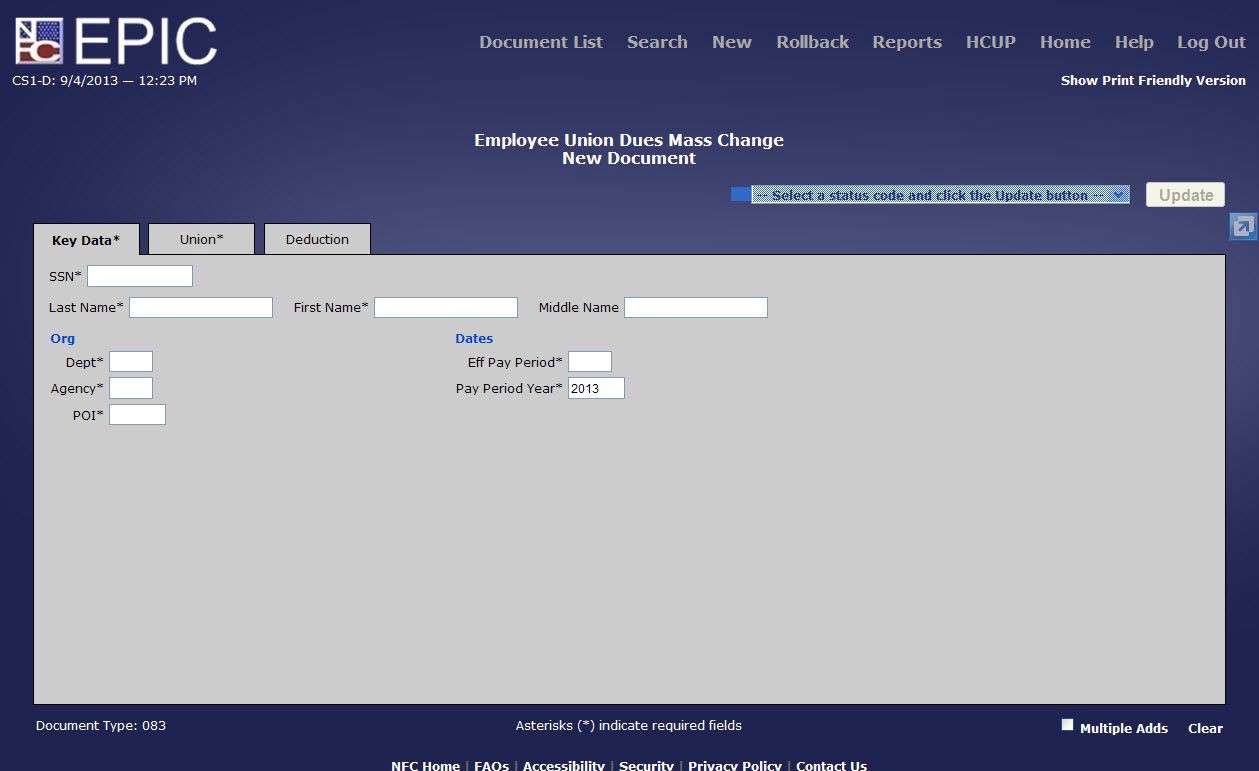

- Select 083 Employee Union Dues Mass Change. The Key Data tab is displayed.

Figure 153: Employee Union Dues Mass Change Key Data* Tab

- Complete the fields on the Key Data tab.

Note: Required fields are marked with an asterisk. All other fields are optional.

Eff Pay Period Field Instruction

Pay Period Year Field Instruction

- Select the Union tab. The Union tab is displayed.

Figure 154: Employee Union Dues Mass Change Union* Tab

- Complete the fields on the Union tab.

- Select the Deduction tab. The Deduction tab is displayed.

Figure 155: Employee Union Dues Mass Change Deduction Tab

- Complete the fields on the Deduction tab.

- Select the applicable Status Input Code from the drop-down list on the top of the page. At this point, the following status input codes are available.

|

Code |

Description |

|---|---|

|

H (Hold until Release) |

To place a transaction on hold. If the status is not changed, the system will automatically delete the action after 60 days. |

|

I (Save as Incomplete) |

To save the transaction that is partially completed and held in EPIC without being edited. After completing the action, change the status code to R or H. If the status code is not changed, EPIC Web will automatically delete the action after 60 days. |

|

R (Release for Processing) |

To release the transaction from EPIC Web to be edited in PINE. |

- Select the Update button to save the entries.

Note: To add an additional address without returning to the menu, select the Multiple Adds link on the bottom right corner of the page. The page is refreshed for the next entry.

Deleting/Canceling Union Dues

A bargaining unit employee moved to a nonbargaining unit position is ineligible for inclusion in a bargaining unit. When a promotion, reassignment, position change, conversion, or change to lower grade personnel action is processed, the dues deductions will discontinue.

When an employee receives a temporary promotion to a position in a nonbargaining unit, the deductions for dues will temporarily stop and store the membership authorization. The dues will be restored when the employee returns to the lower grade.

When an employee in a bargaining unit position is temporarily promoted to a nonbargaining unit position, and a change to lower grade is processed moving the employee to another nonbargaining unit position, membership is canceled and no longer stored in the database.

When the employee receives a permanent promotion is processed for the nonbargaining unit position, the membership is canceled.

The above automatic cancellations and reinstatements are effective no earlier than the end of the processing effective pay period (deductions start or stop the following pay period). If any of these actions are processed late, PPS only stops or starts the membership dues; it does not automatically adjust for over/under deductions. Enter the adjustment in SPPS.

When the wrong organization code is entered, contributions will be made to the wrong organization. In this case, cancel the incorrect union/association and enter the correct date. Enter the adjustment in SPPS.

Note: Process a new authorization after a cancellation; do not process a change.

Note: The Prior Pay Period Adjustment field must be blank except if dues have been deducted in error or if the cancellation was entered prior to the first full pay period following March 1st or September 1st and not processed.