Benefits Statement

The annual statement of employee compensation and fringe benefits, the Benefits Statement, is the estimated value of benefits available to an employee or his/her survivors in the event of voluntary retirement, disability retirement, or death. The Benefits Statement option also displays estimated annuity benefits and account balances from the Thrift Savings Plan (TSP); Old-Age, Survivors, and Disability Insurance (OASDI) and/or Hospital Insurance Tax (HITS)/Medicare benefits; and general guidance.

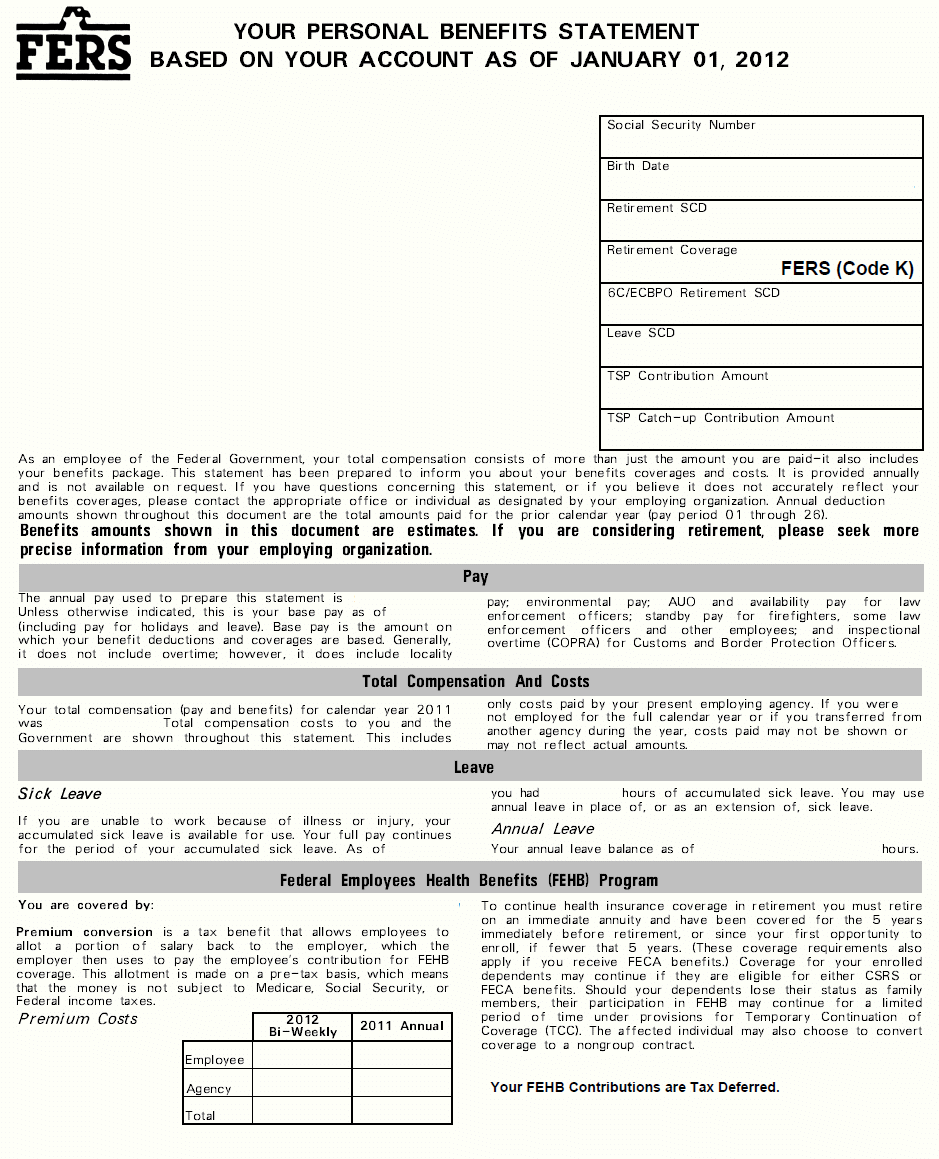

The Benefits Statement option displays the employee’s compensation and benefits.

Figure 62: Your Personal Benefits Statement Page

Who Will Receive the Benefits Statement

The Benefits Statement will be available for each employee who is eligible for retirement benefits and is covered by one of the retirement coverage codes listed below.

|

Code |

Description |

|---|---|

| c |

Civil Service Retirement System (CSRS) Offset |

| D |

CSRS Offset (Congressional) Federal Insurance Contributions Act (FICA) |

| E |

FICA and CSRS - For law enforcement and firefighter personnel |

| G |

FICA and Foreign Service Retirement and Disability System (FSRDS) |

| I |

Federal Employees Retirement System (FERS) (Congressional) FICA |

| IF |

Foreign Service Pension System (FSPS) (Further Revised Annuity Employees (FRAE)) - (Congressional) |

| IR |

FERS-RAE (Revised Annuity Employees) (Congressional) (pending Office of Personnel Management (OPM) approval) |

| K |

FERS and FICA |

| KF |

FERS (FRAE) |

| KR |

FERS-RAE and FICA |

| M |

FERS and FICA - Special |

| MF |

FERS (FRAE) - Special |

| MR |

FERS-RAE and FICA - Special |

| O |

Customs and Border Protection Officers (CBPO) FERS Enhanced |

| OF |

FERS (FRAE) CBPO |

| OR |

FERS-RAE and FICA - Special (CBPO) |

| P |

FSPS and FICA |

| PF |

FSPS (FRAE) |

| PR |

FSPS-RAE and FICA |

| Q |

CBPO CSRS Offset |

| R |

FICA and CSRS (Full) |

| T | FICA and CSRS - Special (Full) - For law enforcement and firefighter personnel |

| 0 | CBPO Enhanced CSRS |

| 1 | CSRS |

| 3 | FSRDS |

| 6 | CSRS - Special - For law enforcement and firefighter personnel |

| 7 | CSRS (Congressional) |

Each part-time employee, with one of the retirement plans listed above and one of the following work schedules, will receive a Benefits Statement for his/her applicable retirement plan:

|

Code |

Description |

|---|---|

| P |

Part-time |

| Q |

Part-time seasonal |

| S |

Part-time job sharer |

| T |

Part-time seasonal job sharer |

Who Will Not Receive the Benefits Statement

Some employees may not receive the Benefits Statement for the following reasons:

- The employee's retirement coverage code is not displayed on the above list.

- The employee's retirement coverage code is not displayed on the above list.

- The employee's 6C Retirement Date identifies the service computation date for employees appointed to law enforcement and firefighter positions or Customs and Border Protection offices. This entails that a special retirement deduction rate (Retirement Coverage Code 0, 6, E, M, O, Q, or T) in the Information/Research Inquiry System (IRIS) Program IR102, Dates & Misc Sal/Pers Data, is invalid. Invalid means that the 6C Retirement Date is earlier than the retirement service computation date or is later than the Benefits Statement date.

- The employee is not eligible for retirement benefits.

- The employee was separated in Pay Period 26 of the prior year or Pay Period 01 of the current year.

- The employee is a Federal Deposit Insurance Corporation annuitant with FERS annuitant indicator A or G or CSRS annuitant indicator 1 or 6.

- The employee's Agency has elected not to issue the Benefits Statement. (See those Agencies below.)

At the Agency's request, the Benefits Statement will not be created for employees of the following Agencies:

- Architect of the Capitol

- Commission on Security and Cooperation in Europe

- Congressional Budget Office

- Consumer Financial Protection Bureau

- Office of the Comptroller of the Currency

- Smithsonian Institution (Trust)

- Treasury Technical Assistance

- U.S. Botanic Garden

- U.S. Capitol Police

- U.S. Senate Restaurants

Also, the Benefits Statement will not be created for employees with the following work schedule codes:

|

Code |

Description |

|---|---|

| I |

Intermittent |

| J |

Intermittent seasonal |