195 Child Care or Alimony Deduction

Child care or alimony deduction is the withholding of court ordered or voluntary child care or alimony payments through payroll deductions. Child care and alimony data can be viewed in IRIS Program IR306, Child Support and Alimony.

Federal employees’ salaries and wages are subject to garnishment for child support and/or alimony payments. This type of garnishment occurs when a Governmental Agency is directed, through legal process, to make a payment for monies otherwise payable to an employee, to another party to satisfy the employee’s legal obligation of providing child support and/or making alimony payments. If garnishment has not been ordered, the employee may voluntarily request payroll deductions for child support and/or alimony payments.

This section addresses the entry of child care and alimony payments based on a dollar amount or a percentage of disposable income. If the payment is based on a percentage of gross wages or if more than three child care/alimony deductions are to be made, the data should not be entered in PPS.

A maximum of three child care/alimony deductions may be entered in the system based on the specific dollar amounts or percentages of disposable income. Maintain and use as required the AD-747, Court-Ordered Child Care or Alimony Deductions, and all copies for three years after the deductions have been completed. Maintain sufficient internal files so that all inquires concerning garnishment cases can be promptly answered.

Once established, cancellations of the garnishment must be ordered by the legal process. Voluntary deductions may be canceled at any time.

Entering 195 Child Care or Alimony Deduction Actions

Note: Enter a separate document for each child care/alimony deduction.

- To enter 195 Child Care or Alimony Deduction actions, select EPIC from the EPIC menu bar. The Document List page is displayed. If a document has been processed, the Document List page is displayed with a list of documents. If no documents have been processed, the Document List page is blank.

- Select New. The New Document Selection menu is displayed. An alphabetical list of Payroll documents appear on this menu.

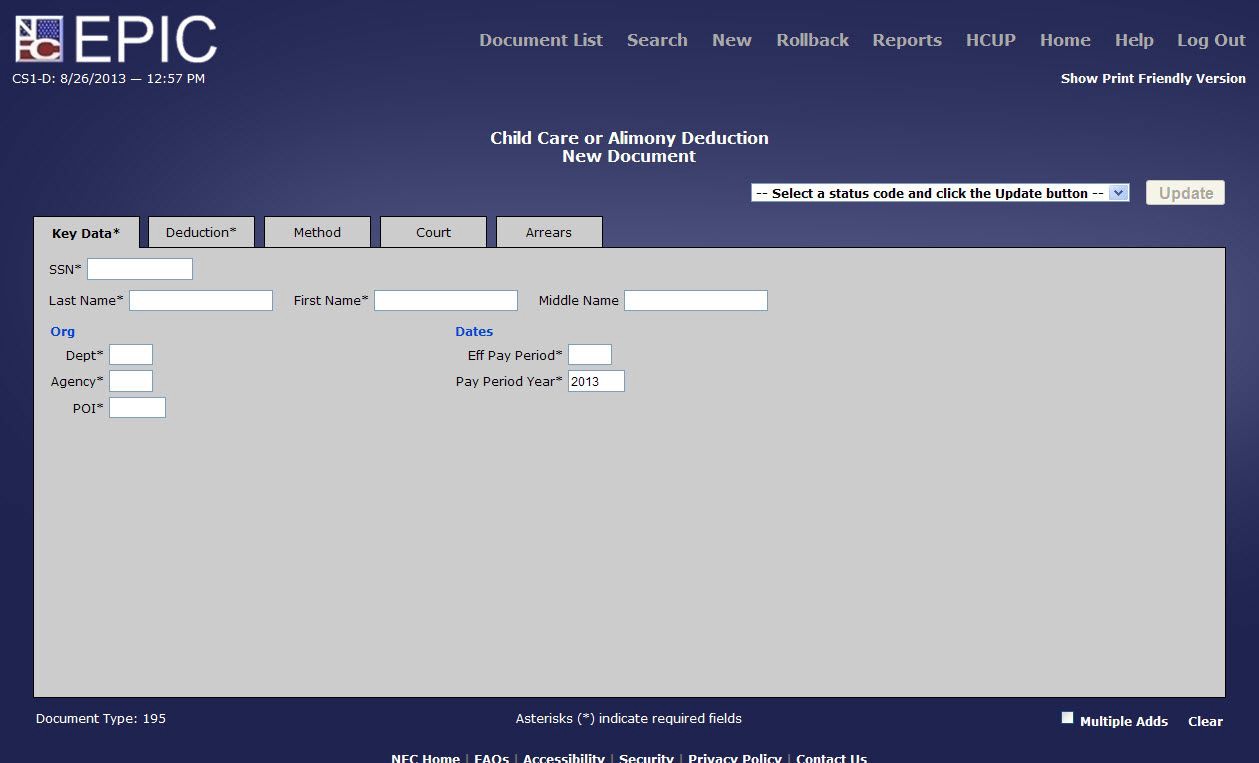

- Select 195 Child Care or Alimony Deduction. The Key Data tab is displayed.

Figure 104: Child Care or Alimony Deduction - Key Data* Tab

- Complete the fields on the Key Data tab.

Note: Required fields are marked with an asterisk. All other fields are optional.

Eff Pay Period Field Instruction

Pay Period Year Field Instruction

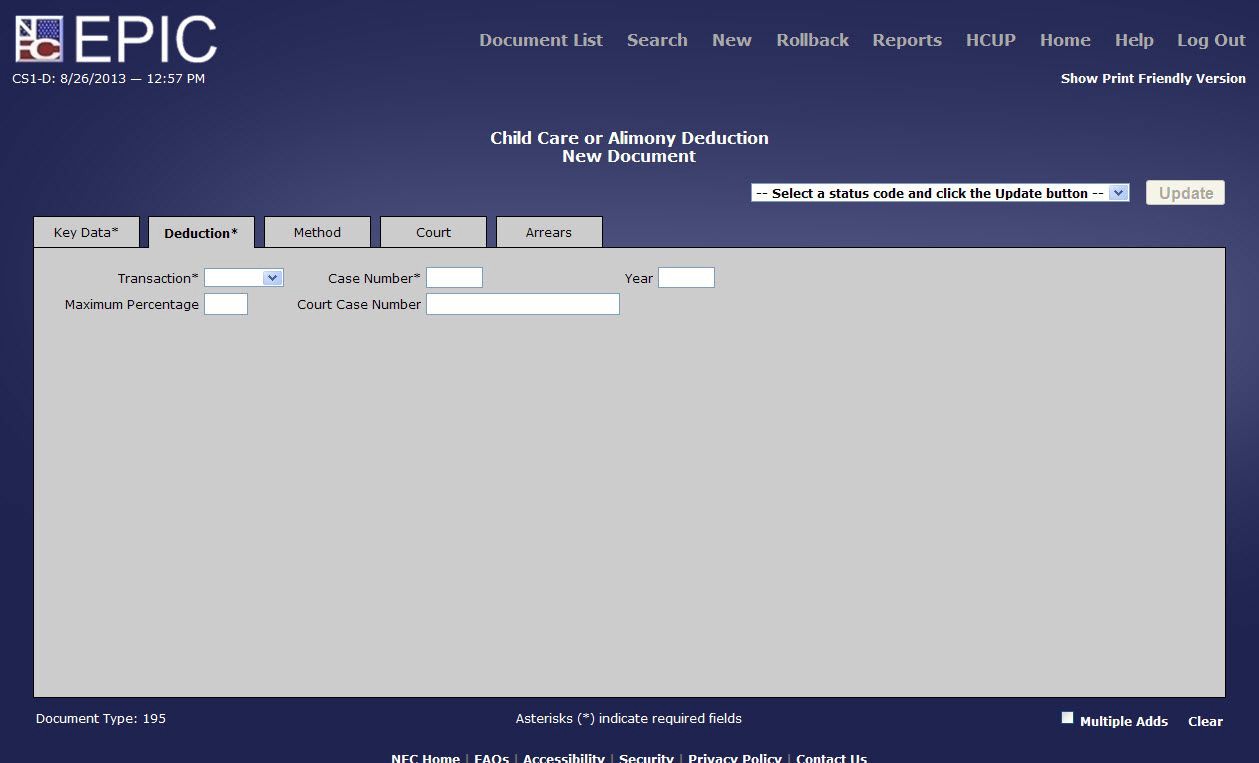

- Select the Deduction tab. The Deduction tab is displayed.

Figure 105: Child Care or Alimony Deduction - Deduction* Tab

- Complete the fields on the Deduction tab.

Court Case Number Field Instruction

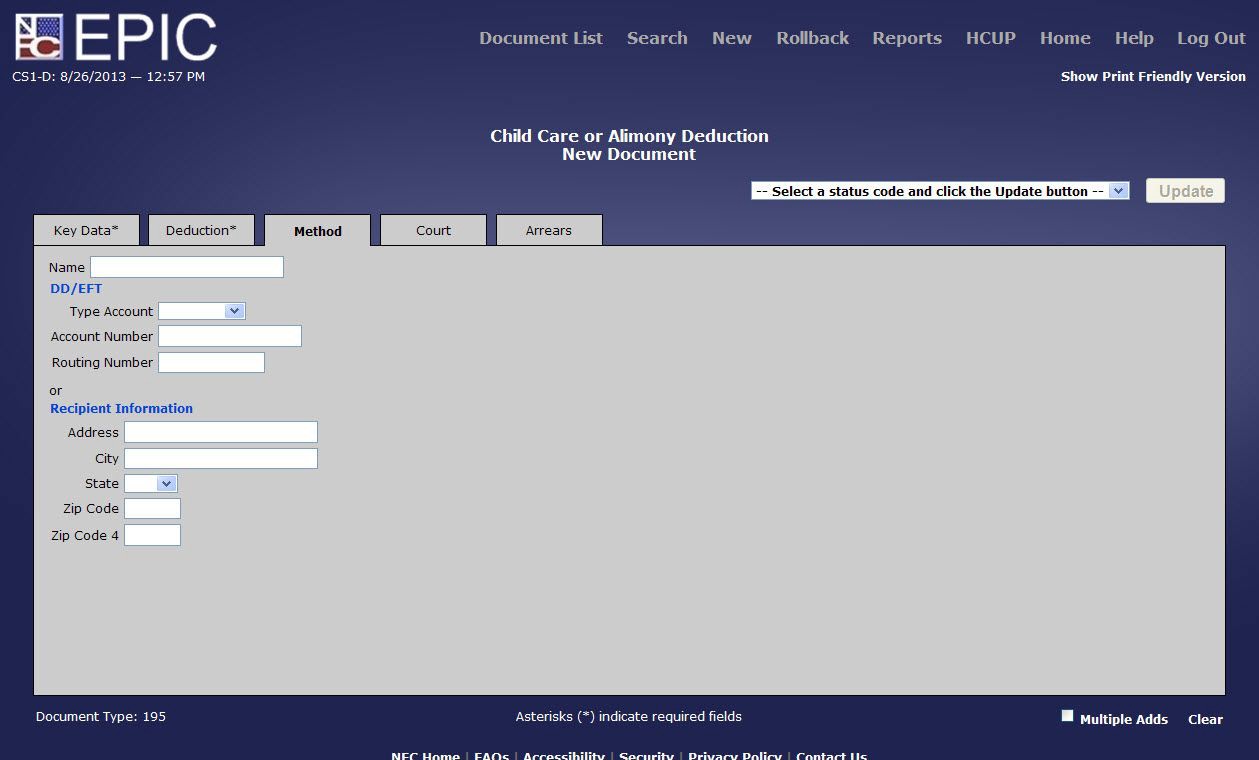

- Select the Method tab. The Method tab is displayed.

Figure 106: Child Care or Alimony Deduction - Method Tab

- Complete the fields on the Method Tab.

Type Account Field Instruction

Account Number Field Instruction

- Select the Court tab. The Court tab is displayed.

Figure 107: Child Care or Alimony Deduction - Court Tab

- Complete the fields on the Court tab.

Total Amount (Court Cost PP Deduction) Field Instruction

Percentage of Earnings (Court) Field Instruction

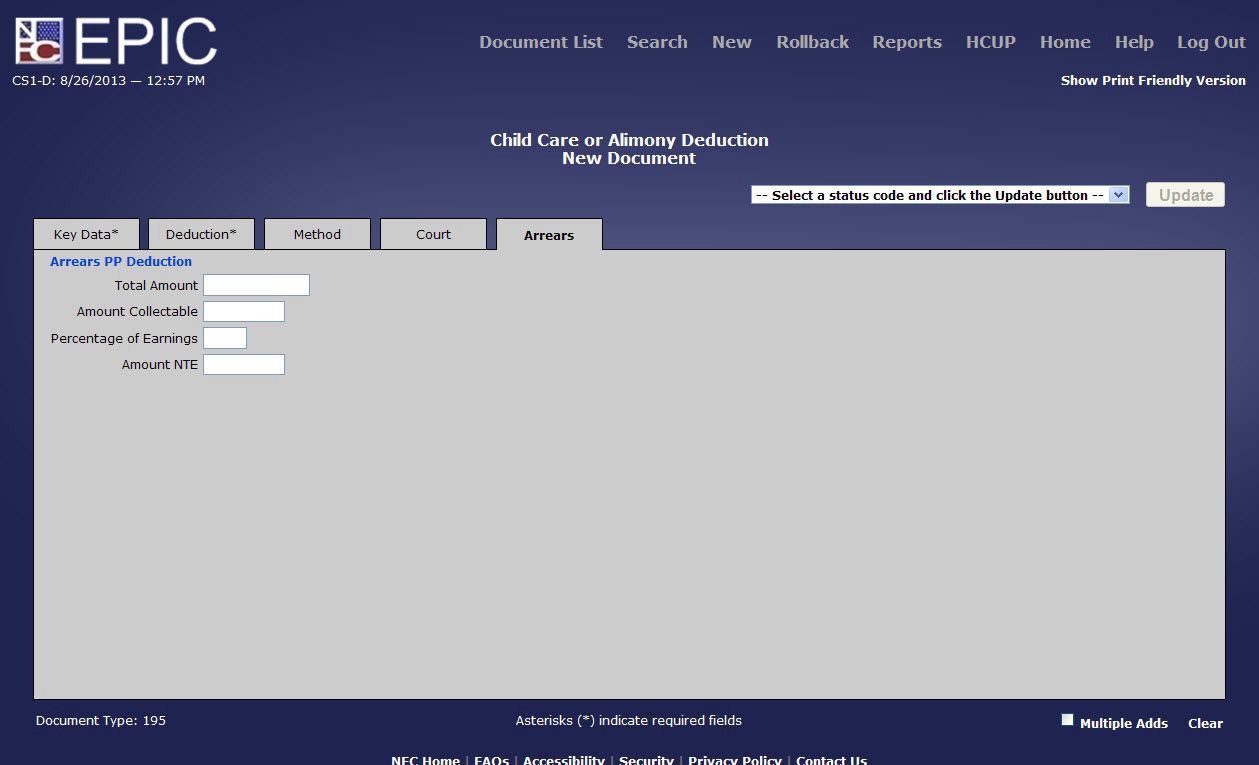

- Select the Arrears tab. The Arrears tab is displayed.

Figure 108: Child Care or Alimony - Arrears Tab

- Complete the fields on the Arrears tab.

Total Amount (Arrears PP Deduction) Field Instruction

Amount Collectable Field Instruction

- Select the applicable Status Input Code from the drop-down menu. At this point, the following status input codes are available.

|

Code |

Description |

|

H (Hold until Release) |

To place a transaction on hold. If the status is not changed, the system will automatically delete the action after 60 days. |

|

I (Save as Incomplete) |

To save the transaction that is partially completed and held in EPIC without being edited. After completing the action, change the status code to R or H. If the status code is not changed, EPIC Web will automatically delete the action after 60 days. |

|

R (Release for Processing) |

To release the transaction from EPIC Web to be edited in PINE. |

Note: To add an additional transaction without returning to the menu, select the Multiple Adds link on the bottom right corner of the page. The page is refreshed for the next entry. A new transaction must be entered for each type of child care or alimony deduction.

- Select the Update button to save the entries.

Modifying a 195 Child Care or Alimony Deduction

If the garnishment payment information changes, for example, from an address to a financial organization, or to a different address, select Change and complete the financial organization information, and/or the recipient address information fields on the Method tab.