Payroll Documents

Payroll Documents allow Human Resources (HR) to enter information related to the employee’s personal data. This section is a guide to enter all types of payroll documents for the employee.

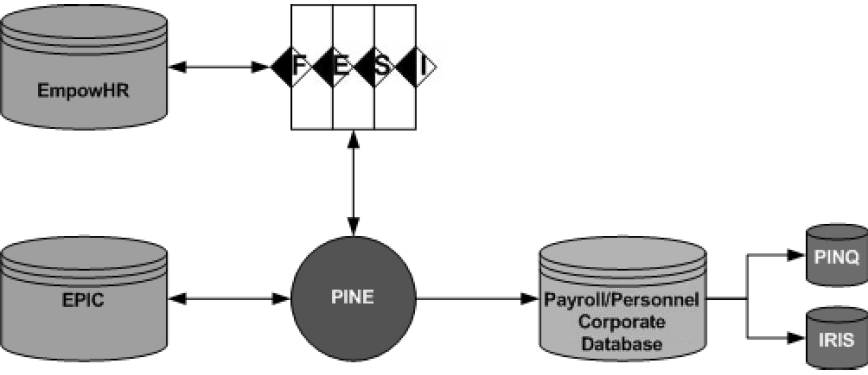

Payroll document transactions are sent to the mainframe and are run through the Personnel Input and Edit System (PINE) process for editing. Transactions that pass the PINE edits are applied to the Payroll/Personnel database and sent to EmpowHR. The Transaction Status on the payroll document will reflect Applied. Transactions that reject to suspense with errors, will reflect Not Applied with an error number and message. If the error is invalid, a user is able to enter an Override Code that tells PINE to let the document pass with the error, thereby forcing the document to apply. A payroll document page with the Override Code check box allows this function. If the error is valid, check the box, make the modification(s) to the rejected payroll document, and select the Save button. The Transaction Status will change to NFC Ready.

Payroll documents are processed to:

- Withhold mandatory and voluntary deductions such as health and life insurance, child support and alimony payments, allotments, and taxes.

- Disburse payments such as annual leave and compensatory time payments.

- Transfer data to the Payroll/Personnel System (PPS) from another payroll system (e.g., leave data transfer).

- Disburse payments through Direct Deposit/Electronic Funds Transfer (DD/EFT).

- Update the database with payroll-related miscellaneous elements, such as restored annual leave and education and professional certification.

The following documents must be processed for a New Hire:

- Net pay

- Tax data

Each type of payroll document will display a Find an Existing Value. Once payroll documents are processed, a View Document Tracking button is available in order to allow users to research document(s). If a View Document Tracking button is selected, a View Document Tracking page is displayed. An employee must be located in EmpowHR in order to enter a Payroll Document for that employee. Enter data in any one of the fields to search for an employee’s data. For more information on the Find an Existing Value, refer to EmpowHR, Section 1, Basics, of this procedure.

Below is an example of a Find an Existing Value.

Figure 1: Example of a Find an Existing Value

Figure 1: Example of a Find an Existing Value

Below is an example of a View Document Tracking button.

Figure 2: Example of a View Document Tracking Button

Figure 2: Example of a View Document Tracking Button

Below is an example of a View Document Tracking page.

Figure 3: Example of a View Document Tracking Page

Figure 3: Example of a View Document Tracking Page

Below is an example of the Payroll Processing Data Flow:

Figure 4: Example of Payroll Processing Data Flow