Entering Lump Sum Leave Payments

- To enter lump sum leave payments, select the Payroll Documents menu group.

- Select the Lump Sum Leave Payments component. The Lump Sum Leave Payments page - Find an Existing Value tab is displayed. The information on this page will allow you to locate an existing employee in order to enter a Lump Sum Leave Payment.

Figure 32: Lump Sum Leave Payments - Find an Existing Value

Figure 32: Lump Sum Leave Payments - Find an Existing Value

- Enter the search criteria.

- Select the Search button. The Lump Sum Leave Payments page is displayed.

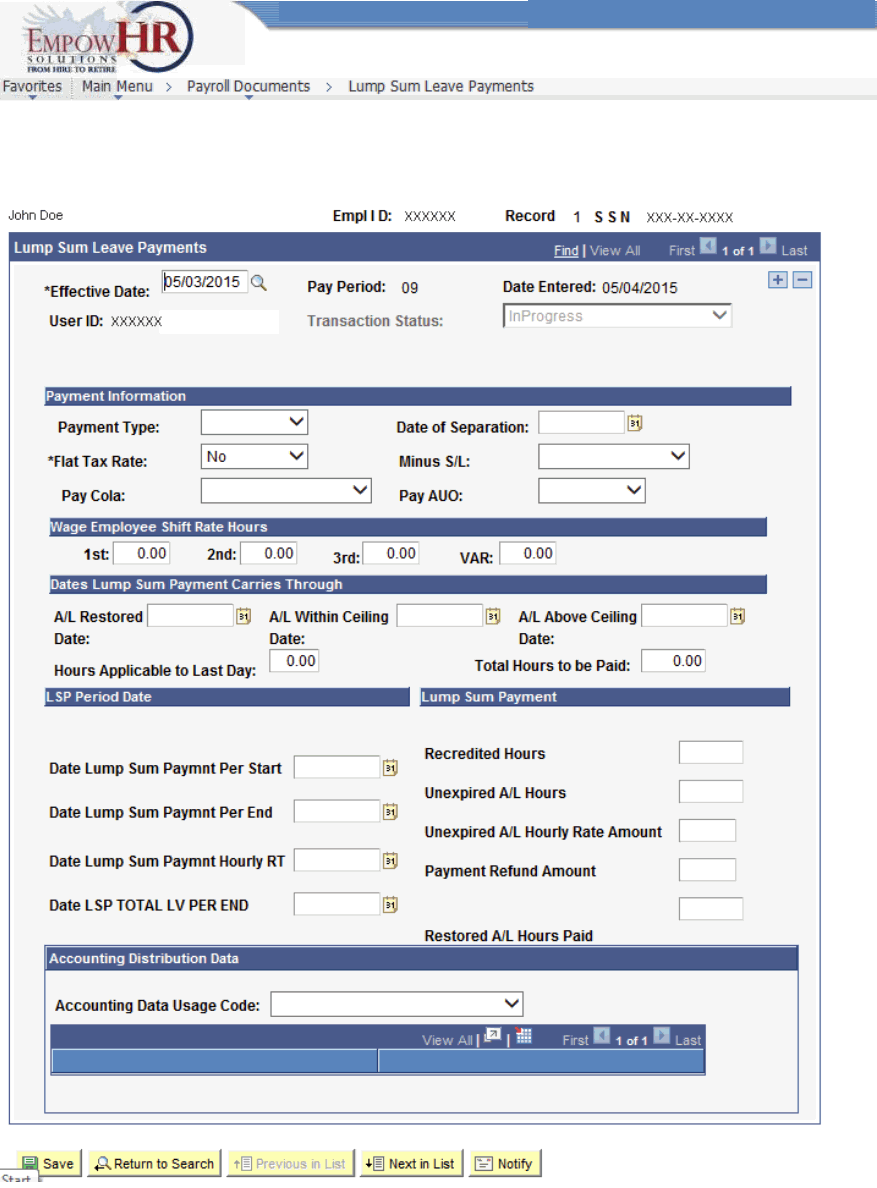

Figure 33: Lump Sum Leave Payments Page

- Complete the fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Name |

Populated from the search criteria entered. |

|

Empl ID |

Populated from the search criteria entered. |

|

Record |

Populated with the number of records for the employee. |

|

SSN |

Populated from the search criteria entered. The employee SSN is displayed based on the Empl ID. |

- Complete the Lump Sum Leave Payments fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Effective Date |

Required field. Populated with the date of the current pay period. To change the date, select the calendar icon and then select the desired date. This date represents the date on which the table record becomes effective; the date that an action begins. This date also determines when to view or change information. |

|

Pay Period |

Populated and cannot be changed. |

|

Date Entered |

Populated with the date the action was entered. |

|

User ID |

Displays the system identifier and name of the individual who generates the transaction. |

|

Transaction Status |

Defaults to In Progress. Select the down arrow to select a different status. |

- Complete the Payment Information fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Payment Type |

Select the payment type from the drop-down list. The valid values are Final for a final lump sum payment for an employee separating from Federal service (the separation action must be entered to pay a final payment; or Interim if an interim lump sum payment is being entered for an employee who is not separating but must be paid the lump sum payment due to regulation and/or policy. A separation action should not be processed for an interim payment. |

|

Date Of Separation |

Enter a date of select a date from the calendar icon. This date must match the separation date on the PAR action. |

|

Flat Tax Rate |

Required field. Select the applicable value from the drop-down list. The default for this field is No. Valid values are: Yes - The Federal income tax is based on the current withholding rate. No - The Federal income tax is based on the database withholding rate. Do not pay at the flat tax rate; pay at the database withholding rate. If No is selected, the Federal tax formula will be used to calculate Federal tax withholding for the lump sum payment based upon the current Form W-4. |

|

Minus S/L |

Required field. If the employee is indebted for sick leave that is forgiven, select Forgiven from the drop-down list. If the employee is indebted and the sick leave is not forgiven and the debt must be paid, select Not Applicable. The sick leave balance on the database must be negative hours. If a sick leave indebtedness does not exist, do not make a selection. |

|

Pay Cola |

If applicable for a cost-of-living allowance (COLA), select COLA information from the drop-down list. Foreign Post Differential is not authorized in lump sum payments. Foreign Post Allowance is authorized but the system cannot pay it automatically. Must submit an SPPS request for payment. The valid values are as follows: COLA - Pay Cola Only COLA & Post Differential - Pay Non-Foreign Post Differential Only No - Do Not Pay COLA or Post Differential Post Differential - Pay Both Non-Foreign Post Differential and COLA |

|

Pay AUO |

Select Yes from the drop-down list if the employee is eligible for administratively uncontrollable overtime (AUO). Select No from the drop-down list if the employee is ineligible for AUO. |

- Complete the Wage Employee Shift Rate Hours fields as follows:

|

Field |

Instruction |

|---|---|

|

1st |

Enter the first-shift rate hours for a Federal Wage System (FWS) employee. |

|

2nd |

Enter the second-shift rate hours for an FWS employee. |

|

3rd |

Enter the third-shift rate hours for an FWS employee. |

|

VAR |

Enter the variable (VAR) rate for a VAR rate FWS employee. |

- Complete the Dates Lump Sum Payment Carries Through fields as follows:

|

Field |

Instruction |

|---|---|

|

A/L Restored Date |

Enter the date the restored annual leave carries through or select a date from the calendar icon. A restored annual leave balance must exist on the database. |

|

A/L Within Ceiling Date |

Enter the date the annual leave, within ceiling, carries through or select a date from the calendar icon. |

|

A/L Above Ceiling Date |

Enter the date the annual leave, above ceiling, carries through or select a date from the calendar icon. |

|

Hours Applicable to Last Day |

Enter the number of hours that are applicable to the last day of the lump sum payment. |

|

Total Hours to be Paid |

Enter the total number of hours to be paid. The hours must agree with the hours on the database. |

- Complete the LSP Period Date fields as follows:

|

Field |

Instruction |

|---|---|

|

Date Lump Sum Paymnt Per Start |

Enter the start date of the lump sum payment or select a date from the calendar icon. |

|

Date Lump Sum Paymnt Per End |

Enter the end date of the lump sum leave payment or select a date from the calendar icon. |

|

Date Lump Sum Paymnt Hourly RT |

Enter the start date for the hourly rate used to determine the lump sum leave payment. There may be multiple rates for a lump sum payment if the employee’s pay is subject to pay adjustment during the lump sum period. Exclude any restored annual leave used for projecting any refund that the employee could potentially owe. |

|

Date LSP TOTAL LV PER END |

Enter the projected end date or select a date from the calendar icon for a period of lump sum leave payment, including any restored annual leave, used toward projecting the total lump sum payment amount. |

- Complete the Lump Sum Payment fields as follows:

|

Field |

Instruction |

|---|---|

|

Recredited Hours |

Enter the applicable recredited hours. |

|

Unexpired A/L Hours |

Enter the number of hours of annual leave in the employee’s lump sum payment for annual leave that is subject to refund to the employing Agency. This leave will be credited to the employee’s annual leave account. This does not include any restored annual leave hours. |

|

Unexpired A/L Hourly Rate Amount |

Enter the hourly rate associated with the unexpected portion of leave. There may be multiple rates for a lump sum payment if the employee’s pay is subject of pay adjustments during the lump sum period. |

|

Payment Refund Amount |

Enter the amount the employee must pay to the employing Agency for every hour of expired leave. |

|

Restored A/L Hours Paid |

Enter the number of hours of restored annual leave paid in a lump sum payment to an employee upon separation. |

At this point, the following options are available:

|

Step |

Description |

|---|---|

|

Select the Save button |

Saves the new data entered. |

|

Select the Return to Search button |

Returns the user to the applicable page to search for another record. |

|

Select the Previous in List button |

Returns to the previous person in the list. |

|

Select the Next in List button |

Advances to the next person in the list. |

|

Select the Notify button |

Notifies the next individual in the workflow. |