Entering Financial Allotments

The following are guidelines for processing financial allotments:

- The saving/checking account must be in the name of the employee.

- The allotment must be a fixed, whole dollar amount that will be deducted from the employee’s salary. No minimum amount is prescribed; however, the whole dollar amount restriction automatically precludes any allotment for less than $1.00.

- The maximum financial allotment in effect at one time is two. If the employee has two allotments, each may be directed to a different financial organization. A separate transaction must be entered for each financial allotment.

- To enter financial allotments, select the Payroll Documents menu group.

- Select the Financial Allotment/Health Sav component. The Financial Allotment/Health Sav page - Find an Existing Value is displayed. The information on this page allows the user to locate an existing employee to enter or change a financial allotment.

Figure 20: Financial Allotment/Health Sav - Find an Existing Value

- Enter the search criteria.

- Select the Search button. The Financial Allotment/Health Savings Account page is displayed.

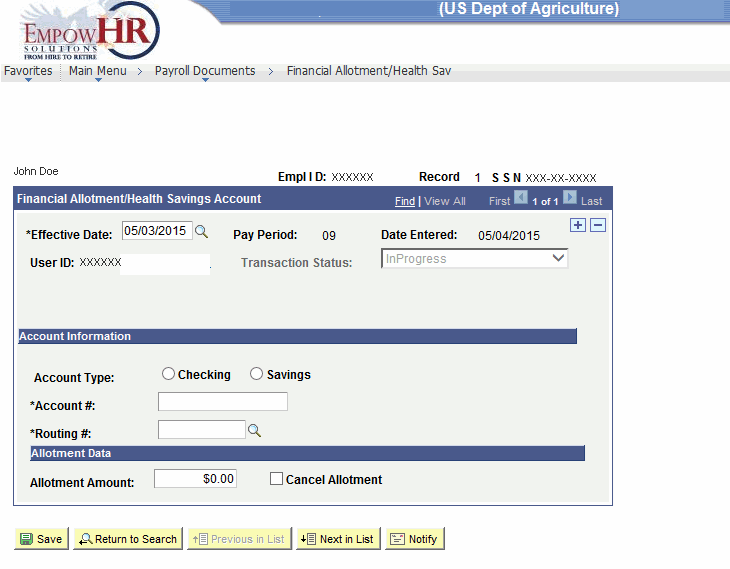

Figure 21: Financial Allotment/Health Sav Page

- Complete the fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Name |

Populated from the Empl ID. |

|

Empl ID |

Populated from the search criteria entered. The employee name is displayed based on the Empl ID. |

|

Record |

Displays the number of records for the employee. |

|

SSN |

Populated from the search criteria entered. The employee SSN is displayed based on the Empl ID. |

- Complete the Financial Allotments/Health Savings Account fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Effective Date |

Required field. Enter a date or select a date from the calendar icon. This is the date on which a table record becomes effective; the date that an action begins. This date also determines when to view or change information. |

|

Pay Period |

Populated with the pay period that corresponds to the effective date. |

|

Date Entered |

Populated with the date the transaction is entered. |

|

User ID |

Displays the system identifier and name of the individual who generates the transaction. |

|

Transaction Status |

Defaults to In Progress and reflects that status of the transaction. The transaction status will change when the transaction is saved, in suspense, or resent to PPS. |

- Complete the Account Information fields as follows:

|

Field |

Instruction |

|---|---|

|

Account Type |

Select the applicable account type for the financial allotment. Valid values are Checking and Savings. |

|

Account # |

Required field. Enter the account number of the savings or checking account. |

|

Routing # |

Required field. Enter the financial organization’s routing number or select data by selecting the search icon. The first two positions must be 01–12, 21–32, or 90–91. |

- Complete the Allotment Data fields as follows:

|

Field |

Instruction |

|---|---|

|

Allotment Amount |

Enter the amount of the allotment. The allotment must be a fixed, whole dollar amount that will be deducted from each salary check. No minimum amount is prescribed; however, the whole dollar amount restriction automatically precludes any allotment for less than $1.00. |

|

Cancel Allotment |

Check this box if the previously established allotment should be canceled. |

At this point, the following options are available:

|

Step |

Description |

|

Select the Save button |

Saves the new data entered. |

|

Select the Return to Search button |

Returns the user to the applicable page to search for another record. |

|

Select the Previous in List button |

Returns to the previous person in the list. |

|

Select the Next in List button |

Advances to the next person in the list. |

|

Select the Notify button |

Notifies the next individual in the workflow. |