Entering Federal Income Tax Data

- To enter federal tax, select Payroll Documents menu group.

- Select the Tax Data menu group. The Tax Data page - Find an Existing Value is displayed. The information on this page will allow the user to locate an existing employee to enter or change tax data.

Figure 46: Tax Data - Find an Existing Value

Figure 46: Tax Data - Find an Existing Value

- Enter the search criteria.

- Select the Search button. A page is displayed with tabs for city, county, State, and Federal taxes.

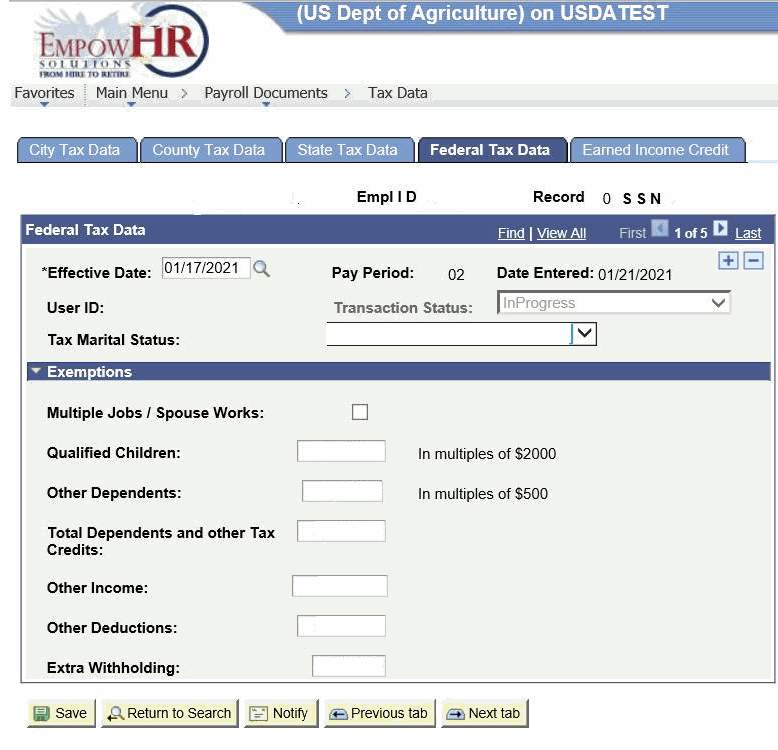

Figure 47: Federal Tax Data Page

The following fields are displayed:

|

Field |

Description/Instruction |

|---|---|

|

Name |

Populated from the search criteria. The name of the employee is displayed from the Empl ID entered. |

|

Empl ID |

Populated from the search criteria entered. |

|

Record |

Displays the number of records for the employee. |

|

SSN |

Populated from the search criteria entered. The employee SSN is displayed based on the Empl ID. |

- Complete the Federal Tax Data fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Effective Date |

Required field. Populated with the beginning date of the current pay period. This is the date on which a table record becomes effective; the date that an action begins. This date also determines when to view or change information. Select a date from the calendar icon to change the default date. |

|

Pay Period |

Populated and cannot be changed. |

|

Date Entered |

Populated with the current date. |

|

User ID |

Populated with the system identifier and name of the individual who generates the transaction. |

|

Transaction Status |

Select the down arrow to select the applicable status. |

|

Tax Marital Status |

Select the applicable status from the drop-down list. The valid values are Exempt, Married filing jointly, Married filing separately, and Nonresident Alien. |

- Complete the Exemption fields as follows:

|

Field |

Instruction |

|---|---|

|

Multiple Jobs/Spouse Works |

Select the box that will store as "Y" when checked or "N" when unchecked. |

|

Qualified Children |

Enter the whole dollar amount only in multiples of $2000 for each qualified child claimed. This field will be hidden when importing in non-originated applied tax documents. |

|

Other Dependents |

Enter the whole dollar amount only in multiples of $500 for each additional dependent child claimed. This field will be hidden when importing in non-originated applied tax documents. |

|

Total Dependents and other Tax Credits |

Enter the total of the Qualified Children and Other Dependents fields. |

|

Other Income |

Enter any tax withheld for other income. This may include interest, dividends, and retirement income |

|

Other Deductions |

Enter the total of other deductions. |

|

Extra Withholding |

Enter the Extra Withholding amount in whole dollars. |

At this point, the following options are available:

|

Step |

Description |

|---|---|

|

Select the Save button |

Saves the new data entered. |

|

Select the Return to Search button |

Returns the user to the applicable page to search for another record. |

|

Select the Previous in List button |

Returns to the previous person in the list. |

|

Select the Next in List button |

Advances to the next person in the list. |

|

Select the Notify button |

Notifies the next individual in the workflow. |

|

Select the Previous Tab button |

Views the data on the previous tab. |

|

Select the Next Tab button |

Views the data on the next tab. |