Entering Allowances

The following are guidelines for processing allowances:

- The allowance total can only be changed for comparability and education allowances. When changing or deleting these allowances, ensure the allowance total does not result in a negative balance.

- If the uniform allowance is to be processed as a lump sum payment, the Allowance Rate field and the Allowance Total field must be the same amount.

- PPS will reduce the Allowance Total by the Allowance Rate each pay period until the Allowance Total reaches zero.

- To enter an allowance, select the Payroll Documents menu group.

- Select the Allowances component. The Find an Existing Value - Allowances page is displayed. The information on this page will allow you to locate an existing employee to enter or change allowances.

- Enter the search criteria.

- Select the Search button. The Allowances page is displayed.

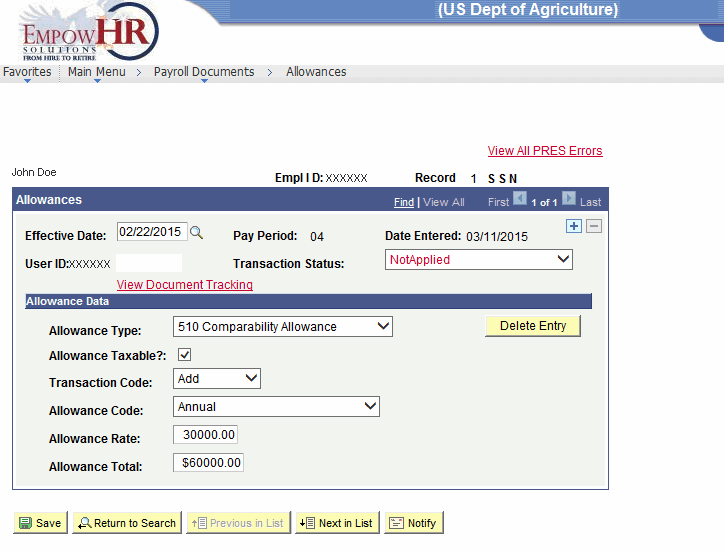

Figure 5: Allowances Page

Figure 5: Allowances Page

- Complete the fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Name |

Populated based upon the results of the search criteria entered. |

|

Empl ID |

Populated based upon the results of the search criteria entered. |

|

Record |

Populated with the number of records for the employee. |

|

SSN |

Populated based upon the results of the search criteria entered. |

- Complete the fields in the Allowances section as follows:

|

Field |

Description/Instruction |

|---|---|

|

Effective Date |

Enter a date or select a date from the calendar icon. The date a table record becomes effective or an action begins. This data also determines when the user can view and/or change information. |

|

Pay Period |

Populated with the pay period of the effective date. |

|

Date Entered |

Populated with the date entered. |

|

Transaction Status |

Defaults to In Progress and reflects the status of the transaction. The transaction status will change when the transaction is saved, in suspense, or resent to PPS. |

- Select the applicable Allowance Type from the drop-down list in the Allowance Type field:

|

Code |

Allowance Type |

|---|---|

|

179 |

Parking Fringe - The per-pay-period amount for parking on or near the business premises of the employer, or on or near a location from which the employee commutes to work by mass transit. The payment is tax exempt. Cannot exceed $80.76 per pay period. Cannot exceed $2100 per year. Note: Timekeepers may record parking on the T&A in lieu of entering the payment in EmpowHR. Do not enter parking fringe in EmpowHR and on the T&A; the T&A will reject. |

|

491 |

Horse Allowance - The lump sum payment amount for furnishing a horse and the necessary equipment for use on the job. This payment is taxable. |

|

493 |

Quarters Allow (Non–Taxable) - The per-day or per-pay-period amount for the cost of rent, heat, light, and water for American citizen civilian employees while living in a foreign area by reason of employment by the U. S. Government. The amount may be taxable or tax exempt. If the payment is based on per day, the timekeeper must record on the T&A (Transaction Code (TC) 49, Remote Worksite Allowance, Suffix 3 or 4) the number of days for which quarters allowance is to be paid. If the payment is based on per pay period, no entry on the T&A is required. |

|

494 |

Quarters Allowance (Taxable) - The per-day or per-pay-period amount for the cost of rent, heat, light, and water for American citizen civilian employees while living in a foreign area by reason of employment by the U. S. Government. The amount may be taxable or tax exempt. If the payment is based on per day, the timekeeper must record on the T&A (TC 49 Suffix 3 or 4) the number of days for which quarters allowance is to be paid. If the payment is based on per pay period, no entry on the T&A is required. |

|

498 |

Reassignment Allowance - The lump sum payment amount for extraordinary, necessary, and reasonable expenses, not otherwise compensated for, incurred by an employee incident to establishment at a post or assignment in a foreign area (including costs incurred in the United States (U.S.) prior to depart for a post assignment in a foreign area) or in the United States between assignment to a post in a foreign area. The amount is taxable. |

|

510 |

Comparability Allowance - The per-pay-period or annual amount also known as the Physicians Comparability Allowance (PCA). A PCA may be paid to a Government physician who is paid under the General Schedule, Senior Executive Service (SES), and certain other pay systems as defined in 5 U.S.C. 5948(g)(1). A "Government physician" includes an individual employed as a physician or a dentist. Agencies may pay a PCA up to $14,000 annually to a physician with 24 months or less of service as a Government physician. Agencies may pay a PCA up to $30,000 annually to a physician with more than 24 months of service as a Government physician. PCAs are subject to the aggregate limitation on pay under 5 U.S.C. 5307 and 5 CFR part 530, subpart B. The payment is taxable. To obtain the pay period amount, the system divides the amount entered in the Allowance Rate field by 80 to determine the hourly rate. The hourly rate is then multiplied by the regular hours in pay status each pay period. To obtain the annual amount, the system divides the amount entered in the Allowance Rate field by 2087 to determine the hourly rate. The hourly rate is then multiplied by the regular hours in pay status each pay period. |

|

511 |

Uniform Allowance (Taxable) - The per-pay-period or lump sum-payment amount for the additional expenses of wearing a uniform required by regulation or statute in the performance of official duty. The amount entered in the Allowance Rate field will be paid each pay period until TC D (Delete) is entered to stop the allowance. Enter the full amount in the Allowance Rate and Allowance Total fields for a lump sum payment. |

|

512 |

Separate Maint Allw (Non–Taxable) - The per-pay-day or per-pay-period amount for additional expense of maintaining family members at a place other than the employee’s post for the convenience of the Government or due to adverse living conditions at the employee’s post. The amount may be taxable or tax exempt. If payment is based on per day, the timekeeper must record on the T&A (TC 51, Comparability Allowance, Suffix 2, Separate Maintenance Allowance - Tax Exempt, or TC 51, Suffix 3, Separate Maintenance Allowance - Taxable), the number of days for which the allowance is to be paid. If payment is based on per pay period, no entry is required on the T&A. The amount entered in the Allowance Rate field will be paid each pay period until TC D (delete) is entered to stop the allowance. |

|

513 |

Separate Maint Allw (Taxable) - The per-pay-day or per-pay-period amount for additional expense of maintaining family members at a place other than the employee’s post for the convenience of the Government or due to adverse living conditions at the employee’s post. The amount may be taxable or tax exempt. If payment is based on per day, the timekeeper must record on the T&A (TC 51 Suffix 2, Separate Maintenance Allowance - Tax Exempt, or TC 51, Suffix 3, Separate Maintenance Allowance - Taxable), the number of days for which the allowance is to be paid. If payment is based on per pay period, no entry is required on the T&A. The amount entered in the Allowance Rate field will be paid each pay period until Delete is selected in the Transaction Code field to stop the allowance. |

|

514 |

Post Allowance - The per-pay-period amount for assignment to a foreign post where the foreign cost of living is significantly higher than in Washington, D.C. The amount is tax exempt. The amount entered in the Allowance Rate field will be paid each pay period until Delete is used to stop the allowance. Enter the data each time the Agency policy is renewed so that the Allowance Total field can be adjusted for the necessary pay period. Enter the full amount in the Allowance Rate and Allowance Total fields. |

|

515 |

Education Allowance - The per-pay-period or lump-sum payment amount for assistance in meeting extraordinary and necessary expenses in providing adequate elementary and secondary education for an employee’s children while serving in a foreign area. The payment is tax exempt. Enter the full amount in the Allowance Rate and Allowance Total fields for a lump sum payment. This amount will be paid in a single pay period. For per pay period payments, enter the amount in the Allowance Rate field to be paid each pay period. This amount will be paid until the IRIS Program IR109, Allowances/COLA/Post Diff, Total field indicates full payment has been made. |

|

516 |

Foreign Language Allowance - The percentage of basic pay that is paid each pay period for employees in foreign service positions to acquire and/or maintain proficiency in foreign languages used at overseas posts. The payment is taxable. The percentage entered in the Allowance Rate field will be paid each pay period until Delete is selected in the Transaction Code field to stop the allowance. |

|

517 |

Recruit/Incentive Allow (Tax) - The lump sum payment amount for recording cash payments offered to selectees of the United States Department of Agriculture (USDA) Demonstration Project. The amount is taxable. Note: Do not complete the Allowance Total field. |

|

518 |

Uniform Allow (Non–Taxable) - The per-pay-period or lump-sum payment amount for the additional expenses of wearing a uniform required by regulation or statue in the performance of official duty. The amount entered in the Allowance Rate field will be paid each pay period until Delete is selected in the Transaction Code field to stop the allowance. Enter the full amount in the Allowance Rate and Allowance Total fields for a lump sum payment. |

|

523 |

Hazardous Duty Allow (Tax) - The per-pay-period amount for hazardous duty for U.S. Capitol Police only. For detailed information, refer to your Agency’s publications. The amount entered in the Allowance Rate field will be paid each pay period until Delete is selected in the Transaction Code field to stop the allowance. The payment is taxable. |

|

524 |

Prof Liability Ins (Non–Taxable) - A per annum reimbursement that allows Federal Agencies to reimburse their management officials, supervisors and law enforcement officers for up to one-half of the cost of their Professional Liability Insurance. |

|

525 |

Transit Benefits - The per-pay-period amount of transit or eligible van pools. The payment is tax exempt. Cannot exceed $50 per pay period. Cannot exceed $1200 per year. |

|

526 |

Parking Benefits - The per-pay-period amount for employee parking. The employee is taxed on the cash value for parking in excess of $230 per month. The amount entered in the Allowance Rate field will be paid each pay period until Delete is selected in the Transaction Code field to stop the allowance. |

|

534 |

Gym/Fitness Reimbursement - The per-pay-period amount for the employee’s gym membership. The amount is up to $40 quarterly with the entire amount being paid in the current pay period with the amount entered in the Allowance Rate field. The Allowance Total field will be generated with the amount in the Allowance Rate field. This allowance is taxable and will be displayed on the employee’s Internal Revenue Service (IRS) Form W-2, Wage and Tax Statement. |

|

535 |

OS Tour Renew Agrmnt Trav - The per-pay-period amount for the round-trip travel for employee and immediate family from posts outside the U.S. to the place of actual residence at the time of appointment to the post of duty, after he/she has satisfactorily completed 2 years of service outside the continental U.S. The Federal Travel Regulation (FTR) permits employees to travel to locations other than their actual residence but reimbursement is limited to the cost of travel to actual residence. This allowance is taxable and will be displayed on the employee's Statement of Earnings and Leave as TC 53, Suffix 05. Note: This allowance applies to all applicable Agencies with the exception of Smithsonian Institution Agencies 72 and 73. |

|

536 |

Education - Taxable - The per-pay-period amount for education expenses for an employee's dependents caused by the employee's service in a foreign area. This applies to Federal employees who are U.S. citizens in a foreign area. This allowance is taxable and will be displayed on the employee's Statement of Earnings and Leave as TC 53, Suffix 06. Note: This allowance is only applicable to those employees under Smithsonian Institution Agency 71. |

- Complete the remaining fields as follows:

|

Field |

Description/Instruction |

|---|---|

|

Allowance Taxable |

Check the box if the allowance is taxable. |

|

Transaction Code |

Select the down arrow to select the applicable transaction for the document. The valid values are Add, Change, and Delete. |

|

Allowance Code |

Select data from the drop-down list. This code indicates how the allowance is to be paid. The valid values are Annual, Per Day, Per Pay Period, and Percent of Base Pay. |

|

Allowance Rate |

Enter the per day, per pay period, annual, percentage of base pay, or full amount rate to be paid in dollars and cents. Note: If entering a 2-year agreement, the amount shown should reflect the annual amount for the first year of the 2-year agreement. A new document must be entered at the beginning of the second year. |

|

Allowance Total |

Enter the allowance total. |

- Select the Save button.

- Select the OK button. At this point, the following options are available:

|

Step |

Description |

|---|---|

|

Select Return to Search |

Returns the user to the applicable page to search for another allowance. |

|

Select Previous in List |

Returns the user to the previous tab. |

|

Select Next in List |

Accesses the next allowance entered. |

|

Select Notify |

Notifies the next individual in the workflow. |